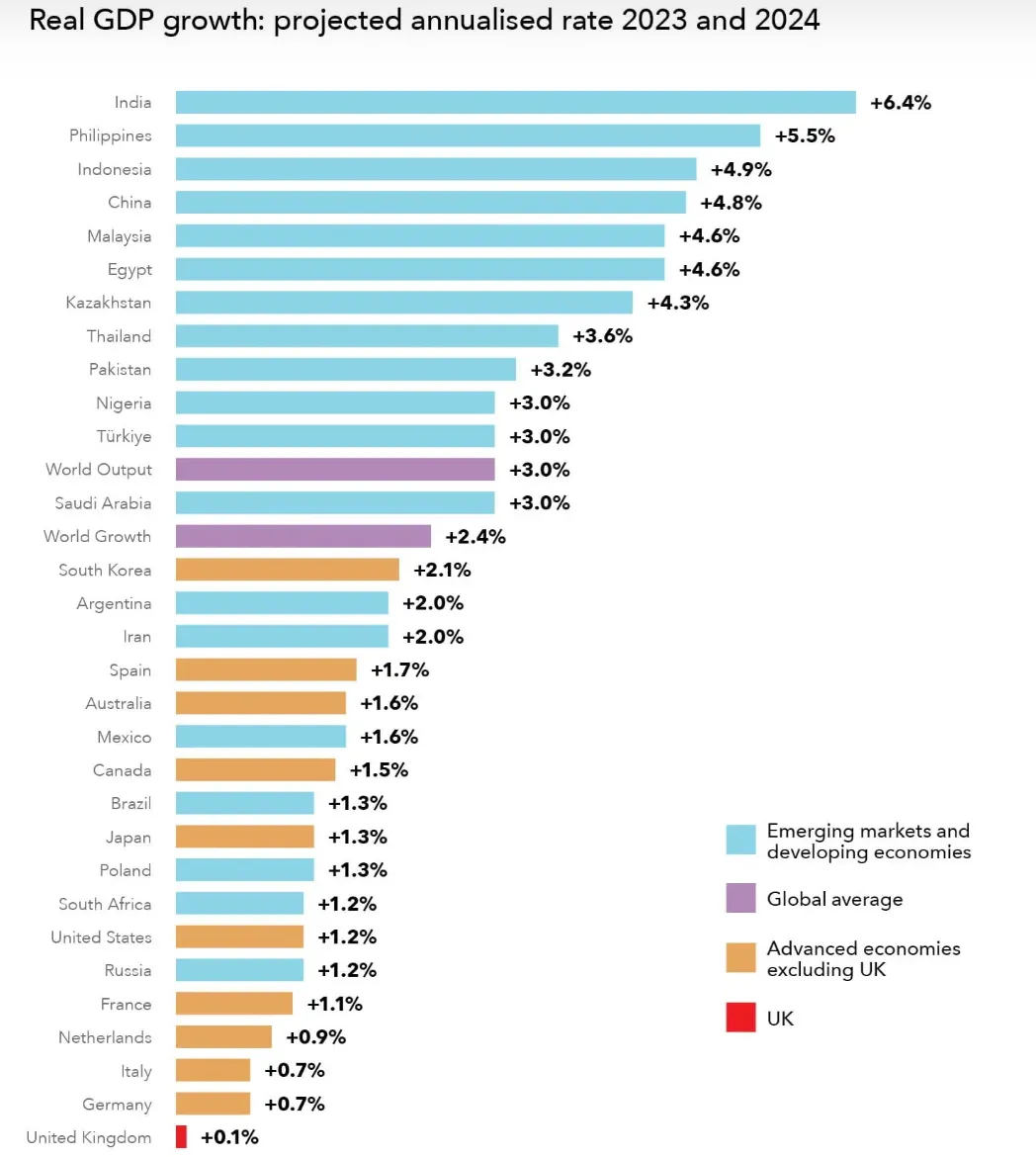

Economic warfare against Russia includes sanctions, disinvestment, asset seizures, oil price caps, and other measures designed to cripple Putin’s economy and war machine. These have certainly caused damage, along with the exit of many multinational corporations and trade bans that have disabled Russian auto and technology manufacturing. But in January, the International Monetary Fund projected that Russian GDP growth in 2023 and 2024 will keep pace with nations that have imposed sanctions against it. Worse, countries refusing to impose sanctions, or those that ignore them or cheat, mostly outperform the 49 nations that have acted to impede Putin’s war. One financial expert commented ironically: “Sanctions might not be having the impact the West had hoped.”

IMF

The sanctions announced by Ukraine’s coalition at the outset of the war were billed as draconian, but a year later the question is whether they are working or not? The answer is both yes and no. When evaluating effectiveness, it’s important to note that Russia lies about its numbers so disruption may be worse than admitted. Secondly, however, Russians have found loopholes, and devised work-arounds, to avoid sanctions with the help of Western “enablers” and other nation-states. Thirdly, the initial energy sanctions were counter-productive because they resulted in price spikes that delivered windfall profits for Russia. And lastly, Russia is not a country, but a criminal organization run by oligarchs whose expertise involves smuggling, money laundering, converting ill-gotten gains into cryptocurrencies, and hiding profits, assets, yachts, portfolios, or themselves from law enforcement anywhere in the world.

Lithuania Says Russian Military Intelligence Behind Ikea Store Arson

Anti-corruption expert Frank Vogl believes sanctions are a flop because the world’s trade and financial systems are rigged. Author of “The Enablers”, and founder of Transparency International, Vogl sums up the situation astutely: “So far, there is neither evidence that Western sanctions have influenced Putin’s determination to crush Ukraine, nor is there evidence that the impact of economic sanctions has been so severe as to unleash domestic unrest in Russia, or challenges in the Kremlin to Putin himself.”

“Never before have so many nations combined to sanction so many individuals in any country as has been the case in Russia. Members of the Duma parliament, Kremlin officials, and scores of businessmen, including the wealthiest so-called oligarchs, have all been subject to travel restrictions, to threats of Western investigations and prosecutions,” he added. “Some of the largest mansions and yachts owned by some of the most prominent oligarchs have been blocked — meaning that their owners cannot use them and are, no doubt, inconvenienced. But actual confiscations of assets, which would hurt the owners, have been few. Forfeiture actions demand that prosecutors provide strong evidence in court that the property is associated with criminal activity.”

“U.S. law provides for the value of confiscated Russian assets to be transferred to Ukraine to help its war effort. That sounds good, but it is meaningless unless large-scale confiscations can be made and so far, the scale of such forfeitures runs in the millions of dollars, not the billions that could make a real difference.”

Further, secrecy and “enablers”, that Vogl, myself, and others have written about for years, have sabotaged sanctions. “Just as economic sanctions against numerous countries over many years have failed to ensure greater international security, so sanctions on individuals appear to have failed to reverse a consistent massive flow of illicit finance from countries run by authoritarian regimes into the world’s largest and most open capital markets – in the U.S., the U.K., European Union, Switzerland, Singapore and Canada.”

Since the invasion, and evidence that Russian techniques have avoided them, the West has tightened sanctions and other forms of economic warfare weaponry. So far, the two most effective prohibitions have been the freezing of Russia’s foreign exchange assets in Western central banks as well as the removal of Russian banks from the Swift transfer system. This has damaged its financial system, the rouble, credit ratings, and market values. But, as Vogl points out, the next step must be to pass confiscation legislation to seize these frozen foreign exchange assets then deploy them to assist Ukraine’s war effort and eventually its reconstruction. This next critical move is already being fought and lobbied against vigorously in Western nations by Russia and its army of Western enablers.

The only way to win the “sanctions war” is to knee-cap Russia’s energy revenues and this is now beginning to work since the institution in December of price caps on its oil and in February caps on its diesel fuel exports. Oil and gas account for more than half of the Kremlin’s revenue, 50 percent of Russia’s export earnings, and roughly 20 percent of the country’s GDP annually. Estimates are that Russia spends roughly US$300 million a day fighting its war but for most of 2022 it earned US$800 million a day from energy exports. Caps have brought inflated prices down dramatically and Europe has nearly weaned itself from Russian natural gas imports. Soon gas sales there will be down to zero and they will remain there because of fuel and source switching as well as the fact that “persons unknown” blew up Russia’s two gigantic undersea pipelines to Germany. Russia says the U.S. did this, but Washington denies that’s the case.

Oil caps are not only crippling the Kremlin but are an ingenuous way to keep petroleum flowing into global markets (to avoid another price spike). Roughly seven million barrels a day have continued to be exported post-war, but the oil cap on December 5 has already caused Russia’s revenue to crash to $200 million a day from $600 million daily. On February 5, caps began on diesel exports and further reduce revenues.

U.S. Treasury Secretary Janet Yellen said at the G20 meeting in February that “we’ve continued to see emerging markets negotiate deep discounts on Russian oil which keeps oil in the global market, but sharply reduces the Kremlin’s take. The way I see it, our sanctions have had a significant negative effect on Russia so far. While by some measures, the Russian economy has held up but Russia is now running a significant budget deficit. The caps we have just set will now serve a critical role in our global coalition’s work to degrade Russia’s ability to prosecute its illegal war. Combined with our historic sanctions, we are forcing Putin to choose between funding his brutal war or propping up his struggling economy.”

Another blow to Moscow is the exit of multinationals, most importantly some of its major oil players. Yale University Professors Jeffrey Sonnenfeld and Steven Tian have compiled a data base containing the names of more than 1,000 corporations, with $50-million or more annual revenues, that have left. These companies had in-country revenues equivalent to 35 percent of Russia’s GDP and employed 12 percent of the country’s workforce, wrote Sonnenfeld.

Unfortunately, hundreds more G7-based companies continue operating in Russia, and the 49 countries that have imposed sanctions account for only 60 percent of the world economy. The rest are trading with Russia. Even so, Russia’s deficits are growing quickly and its war industrial base is unable to resupply its armed forces with ammunition, spare parts, and weaponry. Last week, China was publicly warned by Washington against supplying military aid to Putin and denied it was planning to do so. Another positive development was noted by sanctioned Russian oligarch, Oleg Deripaska, who told The Guardian last week that Russia could run out of money next year.

If China remains on the sidelines militarily, and Russia goes broke, Putin will be forced to stop his war. Unfortunately, predictions at this point amount to wishful thinking.

Published with the author’s permission.

Diane Francis Newsletter on America and the World

30-day free trial at https://dianefrancis.substack.com/about

The views expressed in this opinion article are the author’s and not necessarily those of Kyiv Post.

You can also highlight the text and press Ctrl + Enter